COSEC Services for Sdn. Bhd./ Berhad

Person-in-charge:

Ms. Thanursha (CoSec Associate)

The CoSec services (公司秘书服务) are as follows:

1. Incorporation of a New Company Sdn. Bhd. @ RM 2,162.40 (inclusive of SST);

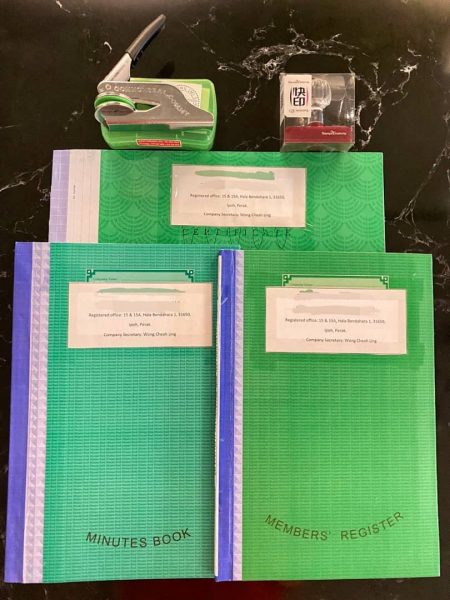

2. Preparing minutes (AGM, EGM, opening of current bank accts and minute’s book);

Why EGM or AGM is extremely important for a company? The Need of EGM

3. Acting as Corporate Secretary, administrative of a whatapps or telegram chatroom and communication with shareholder- through circulars;

4. Safekeeping of Company Common Seal;

5. Ensuring compliance to Companies Act, 2016 and Income Tax Act;

6. Striking of a Company range from RM 1,000.00 to RM 1,400.00(inclusive of doing accounts, closing of bank accts, documents preparation,submission to SSM & LHDN & follow up on the strike-off letter)

7. Company striking-off (Updating LHDN, Banks & SSM) from RM 1,200.00;

8. Company & Business Name Search (RM 100.00) or Change of Company Name (RM 400.00);

9. Registered Office and open for public as per compliance by SSM (Mon- Fri and from 8.30 a.m. to 5. 30 p.m.);

10. Keeping of Statutory Records (annual report, accounts and company registration file);

11. Filling of Annual Returns (RM 250.00);

12. Allotment of Ordinary Shares & Preference Shares and Shares Transfer from RM 200.00 for the 1st & 2nd allotments;

13. Change or updating of Business Nature, Business Address and updating of CoSec (RM 100.00);

14. Change of Object Clause (RM 100.00);

15. Monthly CoSec Retainer fees (RM 70.00 monthly) @ RM 840.00 per annum where we will invoice quarterly;

16. Submission of Annual General Meeting & Financial Statements to SSM @ RM 350.00;

(A sample of SSM compound letter in PDF Version: SSM Compound Letter)

17. For just rental of business address at Ipoh @ RM 40.00 monthly where can receive your letters or parcel on behalf and professional receptionist in call answering;

18. To be sit in with directors for Extraordinary General Meeting (EGM) or Annual General Meeting @ RM 250.00/ hour;

a. Before the AGM :Sending out of registered post of company’s AGM or EGM and annual reports;

b. During the Meeting and inclusive of: registrar at meeting, execution of dividend processing, share splits, bonus shares, registrars at meeting,confirming voting rights and results.

19. Providing CTC to company registration documents at RM 20.00 per set;

20. Printing of SSM docs like Company’s Corporate Profile : Sample Company Profile CTC(1) from MyData; professional charges @ RM 30.00 per set not including the charges from SSM;

21. Corporate Governance where to assist directors in implementing good CG towards in managing the company;

22. SSM Compliance AGM & Audit Reminders where we will send to our respective clients in reminding them the datelines;

23. Preparation of Solvency Statement at RM 100.00;

24. Preparation of Dividend Resolution & Voucher at RM 100.00;

25. Site visit with consultation at RM 250.00 per-hour excluding out-of-pocket expenses;

26. Pocket common seal with 5 red seals at RM 137.80;

27. Courier services to receiver’s doorsteps start from RM 15.00 and pick up at sender’s doorsteps services (depending on the parcel’s weight);

Pocket common seal

28. Crystal Company Chop with Self-Ink at RM 97.80;

The Company Chop

The sample chop (H: 2.5 cm and Wide: 6 cm)

29. Clipper Plate at RM 77.80 ;

30. Common Seal Plate at RM 77.80 per set;

31. Printing of MyData information:

a. Company profile @ RM 45.00

b. Particulars of Directors/ Officers @ RM 55.00

c. Particulars of Share Capital @ RM 55.00

d. Particulars of Company Secretary @ RM 55.00

e. Particulars of Registered Address @ RM 55.00

f. Particulars of Shareholders @ RM 55.00

g. For all CTC copies from SSM, SSM will charge additional RM 15.00

32. Generating of CTOS Lite Report @ RM 80.00 per report.

(CTOS provides individuals with their credit reports that detail their credit history for the past 24 months, legal proceedings, company ownership and directorship, and even testimonies from companies that they have business dealings with.)

Remarks:

-All professional fees are subject to SST Charges and out-of-pocket expenses like stationary and travelling charges.

Monthly CoSec Retainer fees are for:

1. According to Companies Acts 2016 Section 235 (1) each and every Sdn. Bhd. (private limited company) has to have at least one qualified company secretary. Thus the RM 70.00 monthly is for the appointment of the company secretary.

2. Inclusive for the fee for updating of company’s statutory record which is available for audit by auditors or SSM as such register of members, register of directors, managers or CoSec and register of charge.

3. To maintain of CoTax whatapps chatroom in supporting queries on CoSec and Tax matters.

Manpower behind a CoTax Chatr0om

4. The RM 70.00 monthly inclusive of the fee for having our office address as registered office. It’s a requirement under the Companies Acts 2016 to have a registered office which having the function of:

i. To be available anytime for communications, visits & notices between authorities and registrar;

ii. It is open & accessible to the public during ordinary business hours;

iii. The inclusive of the fee for updating of the company statutory record from time to time. For example register of members, register of directors, manager and secretaries, register of charges etc;

iv. Whatapps chatroom support from time to time to advice our clients for CoSec related issues;

v. Special discount with RM 60.00 monthly if the client made one year advance payment to us with the amount of RM 720.00 (RM 60.00 monthly X 12 months);

vi. Professional receptionist for the Company inclusive the works of receiving, courier and email.

vii. To assist estate executor in distributing the will of the estate in case the death of a member or director.

viii. To secure company’s on-going concern in case of any mishaps happens.

The documents in keeping at the Registered Office according to Section 47 (1):

Registered Office

Question: What is Registered Office?

Answer: A company shall at all times have a registered office in Malaysia where all communications, notices & resolutions may be addressed where certain registers & documents are KEPT.

1. Notice of registration issued under Section 15;

2. The constitution of the company (if any): Section 47 (1) (b);

3. Company’s certificate given under CA 2016 : Section 17;

4. All register documents, books, records and registers as required under CA 2016 Section 47 (1) (k), Section 47 (1) (d);

a. Register of substantial shareholders: Section 144 (2);

b. Register of directors, managers and secretaries : Section 57 (1);

c. Register of members and the voting shares : Section 54 (1) & Section 56 (1);

d. Register of Directors’ shareholdings : Section 59 (1);

e. Register of Debenture holders and trust deeds : Section 60 (1);

5. Minutes of all meetings members, communications and resolutions of members: Section 47 (1)(e);

6. Copies of all financial statements and group financial statement Section 47 (1) (h);

7. Accounting records of the company which required under Section 245;

8. Minutes of all meetings & resolutions of the Board, committees of the Board & members Section 47 (1) (g);

9. Copies of all instruments creating or evidencing charges as required under Section 47 (1) (j);

10. Keeping of Annual Return of local and foreign companies: Section 68 (3) & Section 576 (2);

11. Instrument of Transfer of Shares : Section 105 (1);

12. Directors service contract: Section 232 (2);

13. Instrument of appointing of proxies in attending AGM: Section 334 (3);

14. Appointment of Auditors: Section 264 (5);

No business is too small for us.

In Malaysia, incorporation means creating a new company where it is recognized as a legal business entity and is protected under the Malaysian Companies Act 1965 or the the CA 2016.

Incorporating of a company (Sdn. Bhd.) has numerous of benefits which are:

i. Separating between owner and the company.

Owners/shareholders/ directors or managers now having peace of mind in doing their business as his personal assets are safeguarded against the lawsuits or claims from creditors; from example, if the company goes bankruptcy, it is only limited to the amount of investment into the company but not the personal assets of the owners.

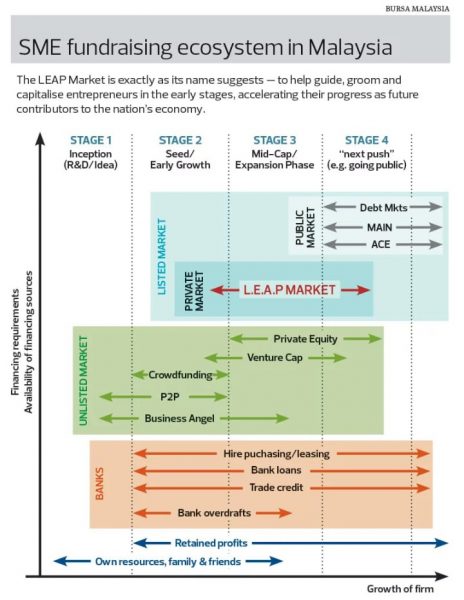

ii. Working capital raising through sale of shares.

Owners can raise working capital through the selling of ordinary or preference shares at promised yearly dividends.

iii. Business’s sustainability.

The business can withstood generations and almost at “infinity” stage where it’s existence is not affected by death of it’s directors, managers, shareholders or even managing director as the shares can be easily transferable through legal procedures.

iv. Credit scores.

It is a norm when owners are to get business loans from bank and the good news is the company can build a separate credit history by applying using the company’s credit but please make sure that the company’s bank statement is in active and positive mode.

v. Government funds, grants and projects.

Some available government funds, grants or projects are only made available from Sdn. Bhd. companies as the project needs to refer to Form 24, 44 and from 49 or new Sections under CA 2016. For example, only Sdn. Bhd. companies are allowed to claim Matrade’s export grant.

So, to those entrepreneurs out there, arrange your strategic moves wisely or ultimately whatapps us @ 018- 66 33308 for better info.

1. COSEC Services & Fees

-

a. Incorporation of Sdn. Bhd. RM 2,183.20/ per company

(https://www.cwca.com.my/pro-support/business-incorporation/company-incorp-sdn-bhd/)

-

b. Incorporation of Berhad RM 3,263.20/ per company

(https://www.cwca.com.my/pro-support/business-incorporation/company-berhad-bhd-formation-package/)

-

c. Company Strike Off from RM 1,000.00 onwards / per company

(Remarks: Preparation of latest accounts, updating to SSM, LHDN and closing of bank accounts). The final charges depends on the complexity of the process.

-

d. COSECs Retainer monthly fees RM 80.00/ monthly

COSECs: Dr. Chong Choong Kian (Licensed Sec @ LS 0010569) or Ms. Cheryl Wong Cheah Ling (Chartered Accountant @ MIA 27235) and for Company with solely engage for only COSEC services, the fees will be RM 100.00/ monthly with clearance one year in advance.

-

e. Filling of Annual Returns RM 350.00/ annually for S/B and RM 750.00/ annually for Bhd.

Filling inclusive of submission of Annual Return and update of Beneficial Ownership (BO)

-

f. Change or updating of Business Details RM 100.00/ per update

(Update of Business Activities, Update of Tax Agent, Update of Business Address, Update of Auditor, Update of CoSec & Update of Registered Address)

-

g. Company & Business Name Search RM 100.00/ per search

-

h. Change of Company Name RM 600.00/ per change

(Price inclusive of a common seal)

-

i. Declaration of Dividend from RM 300.00/ per declaration

(Inclusive with Solvency Statement, Dividend Resolution and Distribution Voucher)

-

j. Allotment of Ordinary Shares & Preference Shares from RM 400.00 onwards/ per allotment

(for 1st and 2nd Allotment)

-

k. Share Transfer of Ordinary Shares & Preference Shares from RM 500.00 onwards/ per transfer

(for 1st transfer and RM 100.00 per subsequent transfer up to 5 transfers per round with inclusive of LHDN SD's submission)

-

l. Company's shares reduction RM 3,000.00 - RM 5,000.00/ per reduction

l. Company's shares reduction RM 3,000.00 - RM 5,000.00/ per reduction(Inclusive of newspaper advertisement for 7 days in 2 major dailies, solvency statement, lodgement to LHDN & SSM)

-

m. AGM Submission and Financial Statement RM 350.00/ per annum

(Submission of Annual General Meeting & Financial Statements to SSM)

-

n. Professional Proxy/ Representative RM 350.00/ per hour

Representing clients in attending events or meetings

-

o. Business Address Rental RM 100.00/ monthly

(For just rental of business address at Ipoh @ monthly where can receive your letters or parcel on behalf and professional receptionist in call answering. Applicable to all existing ROB, Sdn. Bhd. & Berhad only.)

-

p. Sit in with directors for EGM or AGM RM 350.00/ hour

(To be sit in with directors for Extraordinary General Meeting (EGM) or Annual General Meeting (AGM) with inclusive of Agenda & Meeting Minutes but excluding out-of-pocket expenses, technical consulting & research papers.) (AGM Corporate Governance Checklist 2020.pdf)

-

q. Printing of SSM docs RM 30.00/set

(Such as Company's Corporate Profile : Sample Company Profile CTC(1) from MyData); (professional charges not including the charges from SSM)

-

r. Site visit with consultation RM 800.00/hour

(Price excluding out-of-pocket expenses)

-

s. Pocket common seal with 5 red seals RM 130.00/ per set

-

t. Reverse pick-up from RM 50.00/ per arrangement

(Pick up at sender's doorsteps services depending on the parcel's weight)

-

u. Appoint or Resignation of Director/ Beneficial Ownership RM 150.00/ per submission

(Director Responsibilities.pdf)

-

v. Application of Approved Permit (AP) @ DagangNet RM 1,000.00/ per application

-

w. Opening of Bank current accounts RM 100.00/ per reso

w. Opening of Bank current accounts RM 100.00/ per reso -

x. Compliance Reminder through email F.O.C

We will send compliance reminder through email upon we are appointed as the COSECs of the company.

-

y. Register of a brand's Trademark @ Malaysia RM 2,090.00/ per TM submission

Registration fees inclusive to reimbursement payment to MyIPO, publication at Government Gazette and professional follow through but excluding SST but TM is subject to MYIPO's final approval.

-

z. Professional Shares Valuation Report from RM 1,500.00/ per valuation

Methods used: Net Assets and Discounted Cash Flow Method.

-

a1. Special Certified True Copy (S-CTC)/ Witness By stamp from RM 10.00/ per page

Pricing excluding SST charges.

-

a2. Preparation of Banking Facilities, Disposal Resolution & Verification from RM 200.00/ per reso

Pricing excluding SST charges.

-

a3. Preparation of Shares Certificate RM 50.00/ per certificate

Ordinary or Preference Shares Certficate (pricing excluding SST Charges).

-

a4. LHDN's Stamp Duty stamping services from RM 150.00/ per stamping

Tenancy agreement with inclusive of SST but excluding Stamp Duty charged by LHDN.

-

a5. Preparation of Un-audited Financial Statement from RM 1,000.00/ per statement

Pricing excluding of SST charges.

-

a6. Preparation of Audit Exemption Certificate application from RM 200.00/ per application

Audit Exemption Certificate qualification is readable at item 4 L and pricing is excluding from SST charges.

-

a7. Drafting of professional letter with COSEC's CTC or Extract from RM 200.00 / per page

Professional drafting fees is excluding SST of 8%.

-

a8. Revisit of Archive Documents from RM 500.00/ per visit

Professional fees excluding of consultation charges of RM 250.00 per hour for e-consult or at our Ipoh's HQ.

-

a9. Fill & Submission of Company's Economic Survey to Dept of Statistics from RM 250.00/ per case

Professional fees inclusive of SST.

-

a10. Preparation of SSM's Exempt Private Certificate (EPC) RM 500.00/ per EPC

EPC Pro vs Con: Pro are confidentialy and no loans to Director (S 224) while con are bank loan approval, members trust towards the Company and not more than 20 members.

-

a11. Translation of Documents from RM 300.00/ per 2 pages

Translation services available in multi languages: Chinese, Malay, English and Tamil.

-

a12. Removal of Director through EGM/ AGM process RM 432.00/ per removal

The process inclusive of special resolution with 21 days notice (RM 324.00) and register post (RM 108.00) for evidence and the fees are excluding of SST charges.

-

a13. Lodgement of Financial Statement (FS) at MBRS 2.0 RM 300.00/ per submission

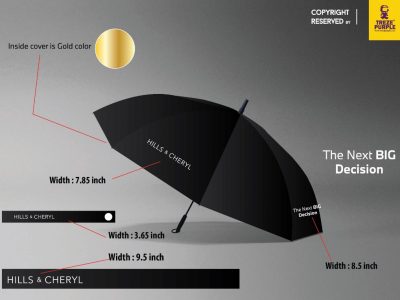

2. Company Stamps, Seals & Corporate Gifts

3. Printing of MyData information

-

a. Company profile RM 65.00

-

b. Particulars of Directors/ Officers RM 55.00

-

c. Particulars of Share Capital RM 55.00

-

d. Particulars of Company Secretary RM 55.00

-

e. Particulars of Registered Address RM 55.00

-

f. Particulars of Shareholders RM 55.00

-

g. For all CTC copies from SSM, SSM will charge additional RM 15.00

-

h. Generating of CTOS Lite Report (per report) RM 100.00

4. Why CoSec is so Important?

- Advise/ Incorporate the Company (Sdn.Bhd./ Berhad), compliance, strike-off & winding up of the company;

- Ensure the Company is compliance with the Company Act, 2016, updating the management with the latest compliance issues and to know our clients well SSM Know Your Client (KYC) Email 12072021.pdf;

- Documenting meeting minutes, resolutions, sitting in as witness during EGM or AGM & votes calculating;

- Ensure Company details are updated, qualified opinions and audit friendly by respective authorities SSM (P1) Common Offences under CA2016 (Part 1) 03102018.pdf and SSM (P2) Common Offences under CA2016 (Part 2) 03102018.pdf;

- Lodging annual reports (financial statements), company’s updates & Annual Return required by SSM;

- To ensure business continuity upon company transition to the new Directors or Directors’ absenteeism;

- To safeguard Company documents at cloud and documents retention;

- To work along with estate distribution party upon Director’s or shareholders’ demise;

- Fulfilling the compliance requirement in appointing a Licensed Company Secretary in the Company;

- CoSec will send compliance reminder through email to the Directors in achieving datelines;

- To help the Company in countering SCAMMING or ILLICIT extract of Company’s private information to 3rd party;

- Arranging of Distribution of Dividend HC Distribution of Dividend (DOD) Process 29012024.pdf process to all members and compliance of the procedure;

- A sample of SSM’s Compliance & Penalties for referencing: SSM AGM Reminder & Compliance CA 2016.pdf

- Application of Audit Exemption Certificate upon meeting criteria: CA 2016 Audit Exemption Certificate (AEC) qualifications 09032023.pdf

5. Monthly CoSec Retainer fees are for:

- According to Companies Acts 2016 Section 235 (1) each and every Sdn. Bhd. (private limited company) has to have at least one qualified Company Secretary. Thus the RM 80.00 monthly is for the appointment of the Company Secretary;

- Inclusive for the fee for updating of Company’s statutory record which is available for audit by auditors or SSM as such register of members, register of Directors, managers or COSECs and register of charge;

- To maintain of COSEC & related Professionals’ Whatsapp chatroom in supporting queries on Company’s matters & compliance reminder through email;

- The RM 70.00 monthly inclusive of the fee for having our office address as registered office. It’s a requirement under the Companies Acts 2016 to have a Registered Office which having the function of:

- To be available anytime for communications, visits & notices between authorities and Registrar;

- It is open & accessible to the public during ordinary business hours;

- The inclusive of the fee for updating of the company statutory record from time to time. For example register of members, register of Directors, manager and secretaries, register of charges etc;

- Whatsapp chatroom support from time to time to advice our clients for COSEC related issues;

- Special discount with RM 70.00 monthly if the client made one year advance payment to us with the amount of RM 840.00 (RM 70.00 monthly X 12 months);

- Professional receptionist for the Company inclusive the works of receiving, courier and email;

- To assist estate executor in distributing the will of the estate in case the death of a member or Director;

- To secure company’s on-going concern in case of any mishaps happens.

- To maintain a fully functional office of a Registered Office in projecting a professional image for the Company;

- HC is having 2 qualified COSECs & team which means there will be always a solid support for the Company.

6. The documents in keeping at the Registered Office according to Section 47 (1):

Question: What is Registered Office?

Answer: A company shall at all times have a registered office in Malaysia where all communications, notices & resolutions may be addressed where certain registers & documents are kept:

- Notice of registration issued under Section 15;

- The constitution of the company (if any): Section 47 (1) (b);

- Company’s certificate given under CA 2016 : Section 17;

- All register documents, books, records and registers as required under CA 2016 Section 47 (1) (k), Section 47 (1) (d);

- Register of substantial shareholders: Section 144 (2);

- Register of directors, managers and secretaries : Section 57 (1);

- Register of members and the voting shares : Section 54 (1) & Section 56 (1);

- Register of Directors’ shareholdings : Section 59 (1);

- Register of Debenture holders and trust deeds : Section 60 (1);

- Minutes of all meetings members, communications and resolutions of members: Section 47 (1)(e);

- Copies of all financial statements and group financial statement Section 47 (1) (h);

- Accounting records of the company which required under Section 245;

- Minutes of all meetings & resolutions of the Board, committees of the Board & members Section 47 (1) (g);

- Copies of all instruments creating or evidencing charges as required under Section 47 (1) (j);

- Keeping of Annual Return of local and foreign companies: Section 68 (3) & Section 576 (2);

- Instrument of Transfer of Shares : Section 105 (1);

- Directors service contract: Section 232 (2);

- Instrument of appointing of proxies in attending AGM: Section 334 (3);

- Appointment of Auditor Malaysia Audit Fee Table Referencing 07022023.pdf: Section 264 (5);

- RO to provide proper facilities to enable the documents and records to be inspected by any person who is entitled to inspect under Section 48 (1).

7. Incorporating New Company

In Malaysia, incorporation means creating a new company where it is recognized as a legal business entity and is protected under the Malaysian Companies Act 1965 or the the CA 2016.

Incorporating of a company (Sdn. Bhd.) has numerous of benefits which are:

a. Separating between owner and the company.

Owners/shareholders/ directors or managers now having peace of mind in doing their business as his personal assets are safeguarded against the lawsuits or claims from creditors; from example, if the company goes bankruptcy, it is only limited to the amount of investment into the company but not the personal assets of the owners.

b. Working capital raising through sale of shares.

Owners can raise working capital through the selling of ordinary or preference shares at promised yearly dividends.

c. Business’s sustainability.

The business can withstood generations and almost at “infinity” stage where it’s existence is not affected by death of it’s directors, managers, shareholders or even managing director as the shares can be easily transferable through legal procedures.

d. Credit scores.

It is a norm when owners are to get business loans from bank and the good news is the company can build a separate credit history by applying using the company’s credit but please make sure that the company’s bank statement is in active and positive mode.

e. Government funds, grants and projects.

Some available government funds, grants or projects are only made available from Sdn. Bhd. companies as the project needs to refer to Form 24, 44 and from 49 or new Sections under CA 2016. For example, only Sdn. Bhd. companies are allowed to claim Matrade’s export grant.

So, to those entrepreneurs out there, arrange your strategic moves wisely or ultimately whatsapp us @ 018- 66 33308 for better info.